Bookkeeping

Your guide to accounting for manufacturing businesses

Just like a chef needs to know the price of ingredients, including the cost of raw materials, to make a delicious and profitable meal, manufacturing companies need to be smart about their spending. In addition to this, manufacturing involves an increased amount of inventory management as tracking costs and cash flow the importance of internal controls in accounting has an even higher significance in this field. Since cost-accounting methods are developed by and tailored to a specific firm, they are highly customizable and adaptable. Managers appreciate cost accounting because it can be adapted, tinkered with, and implemented according to the changing needs of the business.

Invoicing Software and Time and Expense Tracking for Manufacturing

- It integrates easily with third-party software solutions to help with project management.

- Automated and cloud-based accounting solutions have been growing in popularity across different sectors, with global spending on cloud-based services expected to reach $397 billion by the end of 2022.

- The best manufacturing accounting software uses automation to ensure accurately recorded costs throughout the year, reduce admin time, and minimise the risk of human error.

You can be rest assured that your invoices are sent and your payments are collected in a timely fashion. The all-new Accounting Software from FreshBooks empowers manufacturers like you to spend less time on bookkeeping and more time doing what matters most in your business. If you are a customer with a question about a product please visit our Help Centre where we answer customer queries about our products.

Is your cost accounting system costing you?

In fact, large swaths of manufacturing accounting can be viewed as aspects of the larger inventory management process. For example, a manufacturer of made-to-order furniture would likely employ job costing. The last-in-first-out (LIFO) inventory valuation method is the opposite of the FIFO approach. Getting expert tax and accounting advice is worthwhile for virtually every business.

Move beyond ERP with Sage X3

Cloud-based accounting software is very popular because you can update it in real-time from anywhere, including your shop floor. Cloud-based software offers apps for mobile devices, which makes it easy to use for multiple team members. You’ll want to base your accounting software solution on your business needs, but there are some basic features you may want to consider to choose the best accounting software.

BIG DEALS OF COST ACCOUNTING PROCESS FOR A COMPANY

Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs. Taxes are incredibly complex, so we may not have been able to answer your question in the article. Get $30 off a tax consultation with a licensed CPA or how to read a balance sheet EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have. Implement our API within your platform to provide your clients with accounting services. Software for established businesses looking for greater efficiency, flexibility, and insight.

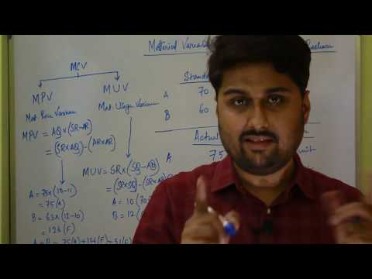

The break-even point—which is the production level where total revenue for a product equals total expense—is calculated as the total fixed costs of a company divided by its contribution margin. Traditionally, overhead costs are assigned based on one generic measure, such as machine hours. Under ABC, an activity analysis is performed where appropriate measures are identified as the cost drivers. As a result, ABC tends to be much more accurate and helpful when it comes to managers reviewing the cost and profitability of their company’s specific services or products. Standard costing assigns “standard” costs, rather than actual costs, to its cost of goods sold (COGS) and inventory. The standard costs are based on the efficient use of labor and materials to produce the good or service under standard operating conditions, and they are essentially the budgeted amount.

To understand why manufacturing accounting differs from other accounting forms, one must first understand how manufacturers produce their products. A Manufacturing account tracks a manufacturing business’s production costs, materials used, and inventory levels. A Factory Overhead account tracks the expenses that a manufacturing business incurs to operate its factory. Features found in accounting software such as inventory management can help you optimize the way you use inventory, such as providing alerts when your stock needs replenishing. It is therefore mostly an internal business management process aimed at better decision-making on budgeting, cost control, constraint and margin analysis, etc. For example, if a purchasing manager procures wire by the foot, an inventory clerk monitors storage by the spool, and the production manager tracks usage by the inch, problems can quickly arise.

Standard costing is very beneficial for creating and polishing budgets as it gives predefined cost estimates that can be measured against actual expenses. The chief disadvantage lies in having to routinely update the standards which can be arduous in case of constantly changing market conditions. The total manufacturing cost also informs two crucial KPIs for determining a company’s Gross Profit and Gross Margin – Cost of Goods Manufactured (COGM) and Cost of Goods Sold (COGS).

You can consolidate all the programs you use for your business to avoid confusion. Your manufacturing business is unique, so FreshBooks designed accounting software just for you. Although some simpler business can get away with single-entry, cash-based accounting, you can’t. Double-entry accounting is a more complete approach and may even be a legal requirement for your company. By failing to record the inventory loss, Rite Aid overstated inventory (an asset) on the balance sheet by $9,000,000 and understated cost of goods sold (an expense) by $9,000,000 on the income statement. This ultimately increased profit by $9,000,000 because reported expenses were too low.

Invoiced is great for businesses that need to keep on top of their accounts receivable and invoicing. It automates everything from payments to reminders to collections, with the goal of getting your company expensing vs capitalizing in finance paid faster — something most manufacturing companies need. FreshBooks accounting software for manufacturing companies allows you to sync with business apps to make operating your business seamless.

Here are brief explanations of some fundamental terms you’ll need to know to succeed. Fortunately, you don’t necessarily have to hire an accountant full-time for your manufacturing business at first. Outsourced accounting from a CPA firm is less expensive and may be enough to meet your needs. As a result, your manufacturing company may get to choose between using cash or accrual accounting.

Rootstock has purpose-built features for real-time inventory management for manufacturers. To help improve and ease accounting for manufacturing, here are 5 best practices for inventory and production cost accounting methods. WAC accounting uses the average cost of all units in inventory and is updated every time a new purchase is made. WAC is easier for manufacturing cost accounting and can smooth out fluctuations in costs or selling prices. A manufacturer may produce those raw materials internally or purchase them from a supplier, but procuring raw materials is the first step. These are referred to as direct materials and are typically itemized in a streamlined bill of materials.

The primary objective is to provide insights into the financial performance and profitability of manufacturing activities, enabling informed decision-making and effective cost management. The income statements of merchandising companies differ from those of manufacturing companies in several areas. In addition, they use the term net purchases instead of cost of goods manufactured and often include the schedule of cost of goods sold in the income statement rather than presenting it separately.

Individually assessing a company’s cost structure allows management to improve the way it runs its business and therefore improve the value of the firm. Since they are not GAAP-compliant, cost accounting cannot be used for a company’s audited financial statements released to the public. Bench helps small businesses automate their bookkeeping and accounting processes, which is great for startups and new manufacturing businesses. They provide you with a team of dedicated financial professionals to help you with all aspects of your bookkeeping and accounting, so you can focus on manufacturing.

This data can then be used to calculate production costs for every step of the process. Cost accounting is an informal set of flexible tools that a company’s managers can use to estimate how well the business is running. Cost accounting looks to assess the different costs of a business and how they impact operations, costs, efficiency, and profits.

This will result in you having better insights into what everything costs to manufacture and how much you should charge for the items you’re making. This will help to identify opportunities to improve efficiencies companywide, drive revenue and increase profit. By carefully managing your inventory levels, you can ensure that you have enough raw materials and finished goods to meet demand without tying up too much cash in excess inventory. A manufacturing account tracks a manufacturing business’s production costs, materials used, and inventory levels.

Finally, there is the cost of managing the manufacturing business and ensuring customers are paying for their goods and suppliers are getting paid for materials. It involves tracking the costs for every item you produce, including direct materials, direct labor, and manufacturing overhead. It’s like a detailed grocery list (bill of materials) and a careful budget (job costing), ensuring the total cost doesn’t eat into profits. A Manufacturing account tracks a manufacturing business’s production costs, materials used, and inventory levels. Manufacturing accounts can also help businesses manage their cash flow and budget for future production. This article explains what manufacturing accounting is, the types of manufacturing costs that must be accounted for, and how to accurately value production costs using different methods and technologies.

0982.226.306

0982.226.306 duoclieuannam@gmail.com

duoclieuannam@gmail.com Hệ thống cửa hàng

Hệ thống cửa hàng Đăng ký nhận quà

Đăng ký nhận quà